$28.6 Billion Funding for Restaurants in The American Rescue Plan act of 2021

Posted on |

American Rescue Plan act of 2021: What are the options and, or opportunities available to restaurants?

The America Rescue Plan act of 2021, outlines $1.9 trillion in COVID-19 related relief funding. The bill has passed the House of Representatives and is expected to be signed by President Joe Biden before March 14, 2021. The full proposed bill can be accessed here.

This bill is very important and has implications to provide financial aid or relief to just about every industry. In this post we’ve highlighted some of the major loan, grant and tax-credit opportunities specifically for restaurants.

Direct support for restaurants via the Restaurant Revitalization Fund is estimated to arrive at an additional $28.6 billion, with $5 billion reserved for smaller, independent operations. Grants (such as the Restaurant Revitalization Grant) can be taken alongside other programs such as PPP, EIDL and Employee Tax Credits, but terms do apply. Use the navigation below to skip between sections. Each section will specify the criteria for eligibility.

Grants for Restaurants – $28.6 billion

Section. 5003 – Support For Restaurants

As part of the Restaurant Revitalization Fund

There’s a total of $28.6 billion in grants available to restaurants, bars, caterers, food trucks and other foodservice providers. See more in the details below.

Details:

- Grant amount would be equal to the difference between a restaurant’s gross receipts pre-pandemic 2019 and gross receipts of 2020

- OR an amount based on a formula determined by the “administrator” (owner/operator)

- Find out how much you’re eligible for by using our Restaurant Revitalization Grant Calculator

- Grants can be spent on payroll and benefits, mortgage, rent, utilities, maintenance, supplies, PPE, cleaning, supplier food costs, operational expenses and paid sick leave

- OR any other expense that the administrator (owner/operator) deems essential to maintaining operations

- Up to $5 million per location, up to $10 million total

- Covered period is February 15, 2021 – December 31st, 2021

- Grants would prioritize restaurants that are owned and operated by women, people of colour or veterans

- One fifth (⅕) of the funding ($5 billion) is reserved for businesses that grossed less than $500,000 in receipts in 2019

- Grants can be taken alongside two rounds of PPP, EIDL and Employee Retention Tax Credits

Grants can be taken alongside the two rounds of PPP, EIDL and Employee Retention Tax Credits, though PPP loans already received will be subtracted from the eligible grant total for any individual business

Grants are calculated differently based on how long a restaurant has been open and the PPP loans they might have already received. For example, for established restaurants that opened in 2018 or earlier, grants are calculated by subtracting a business’ 2020 revenue from their 2019 revenue, and also subtracting first- and second-draw PPP loans received in 2020

- Any restaurant, bar, caterer, food truck, foodservice provider, brewery

- “(A)means a restaurant, food stand, food truck, food cart, caterer, saloon, inn, tavern, bar, lounge, brewpub, tasting room, taproom, licensed facility or premise of a beverage alcohol producer where the public may taste, sample, or purchase products, or other similar place of business in which the public or patrons assemble for the primary purpose of being served food or drink”

- Business has less than 20 locations

- Restaurants or conglomerates that are publicly held or traded

- Meet certain criteria in relation to private equity funded entities

- Applicants who are ALSO applying for Shuttered Venue Operators Grant (SVOG)

- State or Government operated businesses

Restaurant Owners/Administrators that receive the Restaurant Revitalization Grant (as under the Small Business Administrator grant under section 5003):

- The amount will NOT be included in administers Gross Income

- “No deduction shall be denied, no tax attribute shall be reduced, and no basis increase shall be denied, by reason of the exclusion from gross income provided”

Economic Injury Disaster Loan (EIDL) Advanced Grants – $15 Billion

The Economic Injury Disaster Loan (EIDL) is aimed to support small businesses in underserved, low-income communities that have been the most affected by the pandemic. There’s a total of $15 billion funding for the EIDL.

There will be 3 “windows” of eligibility under the EIDL. The first window will start with businesses that didn’t receive the full amount of funding that they previously applied for. Note: EIDL Advanced Forgivable Grants are no longer available. All EIDL going forward will be EIDL loans unless specified otherwise.

Details:

- Small business will be eligible for up to $10,000 each

- $1,000 per employee, up to $10,000

Eligible Businesses – First Window

- No more than 300 employees

- Suffered a loss of gross receipts of more than 30% during an 8-week period between March 2nd, 2020 and December 31st, 2020, compared to an 8-week period prior to March 2nd 2020.

- Have fewer than 10 employees

- Have endured losses of over 50%

- Fewer than 10 employees

- Losses between 30% and 50%

Loan Terms:

- 3.75% Fixed for businesses

- 30-year maturity

- No prepayment, penalty or fees

- Deferred payments for one year, interest still accrues

- Borrowers can make payments if they choose to do so during year one.

- Collateral needed for loans over $25,000

Paycheck Protection Program (PPP) – $7.25 billion

The Paycheck Protection Program (PPP) has received an extra $7.25 billion in funding and has expanded its coverage, but there has not been an extension of time for businesses to apply. Currently, applications for PPP are due by March 31st, 2021.

(apply for the Paycheck Protection Program here)

These government loans are meant to support businesses and payrolls directly, and can qualify for forgiveness.

First & Second Draw PPP

Many businesses may have already received the first-draw of PPP Loans. If your business has not, the first draw may be available to your business or restaurant. If you have already received the first-draw, you may apply for the second.

Details:

Loans can be used to help fund payroll costs, including benefits, and may also be used to pay the following.

- Mortgage interest

- Rent

- Workers protection related to COVID-19

- Damaged property caused by looting or vandalism during 2020

- Certain operational or supplier costs

SBA will forgive the loan if all employee retention criteria is met and the funds are used for eligible expenses over the 8-to-24 week covered period following loan disbursement:

- Employee compensation levels are maintained (to the same level as the first-draw, for the second-draw)

- The loan proceeds are spent on payroll costs and other eligible expenses

- At least 60% of the proceeds are spent on payroll costs

- Sole proprietors, self-employed persons or independent contractors

- Small businesses that meet the SBA’s size standards. (Check if you qualify here)

- Any business with a NAICS code that begins with 72 (Accommodations and Food Services) that has more than one physical location and employs less than 500 per location

- Expanded to include small business owners with prior convictions that are not fraud-felonies

- Expanded access for small business owners who are non-citizens and lawful U.S residents. (Taxpayer Identification # is required in the application)

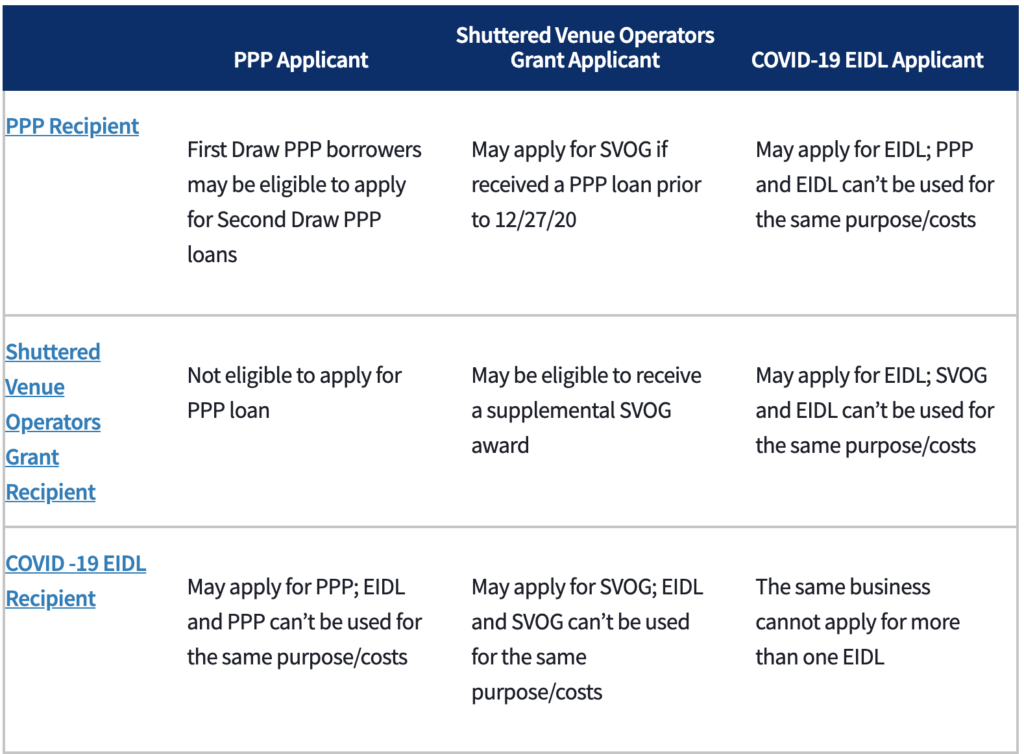

- PPP loans are eligible to be exercised alongside Restaurant Relief grants and EIDL loans

- PPP and EIDL can’t be used for the same expenses

Shuttered Venue Operations Grant (SVOG) – $1.25 billion

Section. 5005

Shuttered Venue Operations Grant refers to any venue, festival, or live event that has been affected by the pandemic.

Details:

- Venues, institutions (festivals)

- Grants are equal to 45% of the venues Gross revenue in 2019 or $10 million max

- SBA has yet to enact the existing live-venue grant program, which passed in the last relief package

- Worth $15 billion when live

- Cannot apply for PPP loan and an SVOG at the same time (per Economic Aid Act)

- If PPP was received prior to December 27th, 2020, you are eligible to apply for SVOG

- EIDL and SVOG can be applied for at the same time, but cannot be used for the same purpose/costs

- Principal Business Activity is live events

- Mobile, portable or touring, traveling tent shows (circuses, festivals, space-related requirements)

- Independent contractors (food trucks) do not qualify (likely should apply for Restaurant grant, PPP instead)

- Not currently applying for Restaurant Revitalization Grant

Extending Employee Retention Credit

Section. 9651

With new legislation, eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to 70% of the qualified wages they pay to employees after December 31, 2020, through Dec 31, 2021.

- New bill; businesses can claim a refundable credit equal to as much as $7,000 per employee, per quarter

- Employers this year would qualify for up to $28,000 per employee

Eligible Businesses

- Companies that experienced full or partial suspension of operations as a result of government mandates

- Or those that can show at least 20% reduction in quarterly gross receipts, compared to the same quarter in 2019

- Companies eligible for the 2020 credit must show a more than 50% decline in gross receipts

- Recipients cannot take a tax deduction on expenses paid for with PPP funds, as a continuation of current laws.

Cross-Program Eligibility

For more information on Cross-Program Eligibility, please visit SBA Website.

Thankfully for the restaurant and food-service industries, financial aid is on the way. If you have any questions please feel free to reach out to us. We hope you found this helpful, and are wishing you and your restaurant a profitable 2021and beyond.